Where Are DeepSeek Data Centers Located

DeepSeek shocked the tech world in early 2025 by releasing AI models rivaling GPT-4 at a fraction of the cost, achieved through a distributed network of computing infrastructure spanning coastal cities, inland hubs, and even underwater facilities. DeepSeek's data center strategy reflects China's "Eastern Data, Western Computing" initiative and creative workarounds to U.S. chip export restrictions. Understanding DeepSeek's infrastructure reveals how the company scaled AI capabilities despite geopolitical constraints and hardware limitations.

DeepSeek's Domestic Data Center Network

DeepSeek operates from two primary Chinese locations, keeping all user data within mainland China's borders.

Hangzhou (Headquarters)

Zhejiang Province | Founded mid-2023

- Core function: Primary R&D center and computational hub

- Houses the initial computing cluster for model development

Beijing

Haidian District, Raycom InfoTech Park | Established May 2024

- Core function: Business operations, government relations

- Strategic value: Proximity to regulators and industry partners

- Likely serves Northern China users with additional servers/cloud access

Data Sovereignty

All user data stored on secure servers within mainland China per DeepSeek privacy policy

- Complies with Chinese data sovereignty regulations

- Ensures direct control of sensitive information within national borders

Inner Mongolia's Computing Hubs

Three major intelligent computing centers in Hohhot form the backbone of DeepSeek's AI services, representing China's push for self-reliant AI infrastructure.

China Mobile's Flagship Facility

Horinger New Area, Hohhot

Scale: 6,700 PetaFLOPs (6.7 exaFLOPs)

- World's largest single intelligent computing site operated by a telecom provider

- ~20,000 AI accelerator cards

85% domestically manufactured chips (Huawei Ascend, Biren processors)

- Direct response to U.S. export controls

- Demonstrates China's self-reliant AI infrastructure strategy

DeepSeek integration: Full functionality across all model versions on China Mobile's cloud platform

Supporting Facilities

Paratera Technology Computing Base

- Target capacity: 60,000 PetaFLOPs

- Hardware mix: Nvidia H800/A800 chips (export-approved versions) + Huawei Ascend 910 processors

BONC Hohhot Intelligent Computing Center

- Scale: 8 centers, 10,000 server cabinets

- Massive data park infrastructure

Deployment Status

All three facilities completed DeepSeek model deployment by mid-2024, confirming Inner Mongolia as DeepSeek's computational backbone.

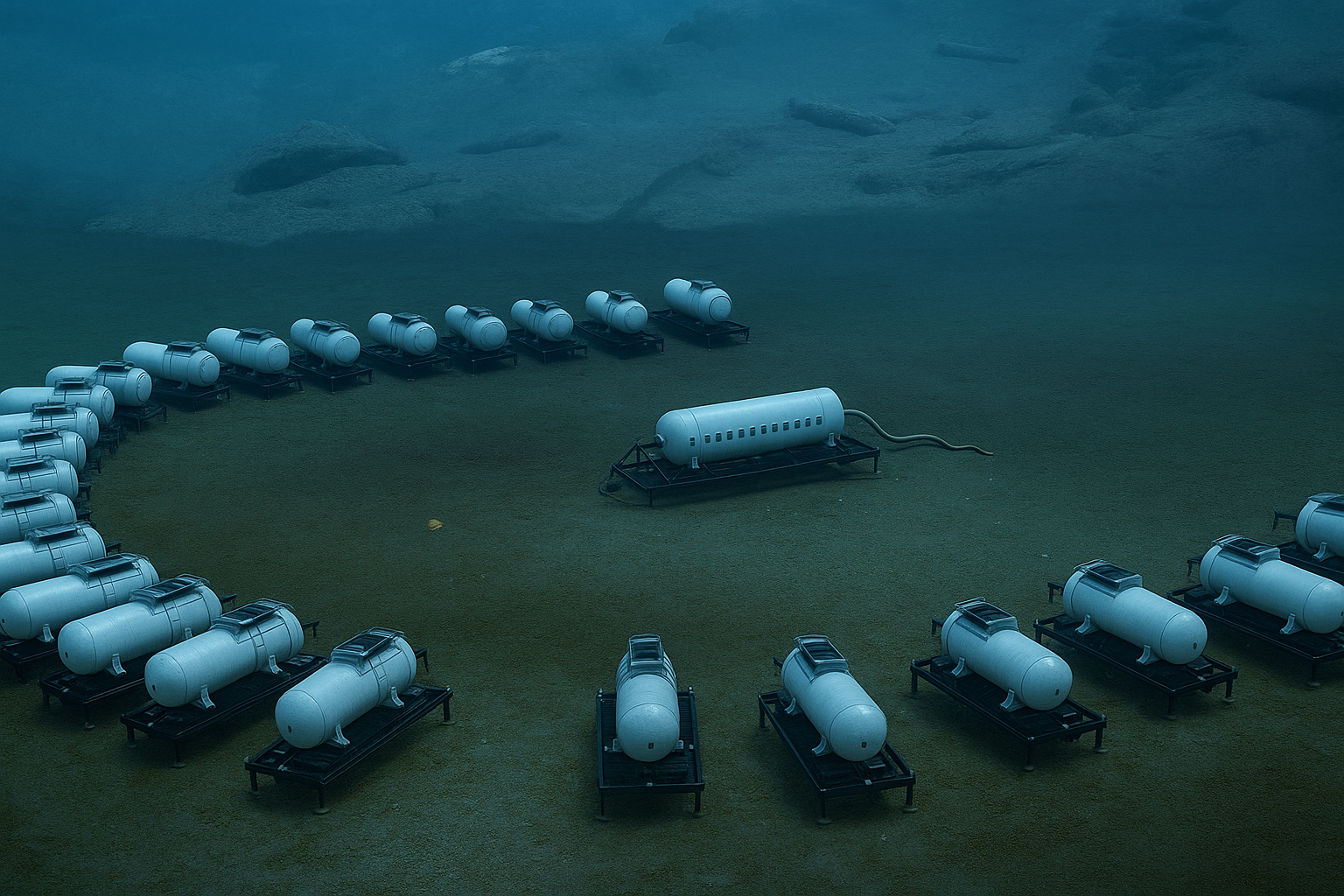

Underwater Data Center in Hainan

The most innovative piece of DeepSeek's infrastructure is its underwater data center located off the coast of Lingshui, Hainan Island. This subsea computing cluster, operated by Shenzhen Highlander and China Telecom, consists of sealed server capsules positioned on the seafloor that use ocean water for cooling.

In February 2025, a new module was added to the facility, boosting its capacity to over 400 high-performance servers. The underwater cluster now provides computing power equivalent to approximately 30,000 gaming PCs and can handle about 7,000 concurrent DeepSeek AI conversations per second.

This innovative approach addresses multiple challenges: it improves energy efficiency through natural seawater cooling, expands computing capacity without consuming valuable land resources, and demonstrates China's willingness to explore unconventional solutions to infrastructure constraints. The facility supports not only DeepSeek's model training and inference needs but also other workloads including game rendering and marine research.

International Expansion: Saudi Arabia

DeepSeek made its first confirmed international deployment in early 2025 with the launch of operations at the Aramco Digital Data Center in Dammam, Saudi Arabia. Announced at Saudi Arabia's LEAP 2025 tech conference, this expansion was part of the kingdom's broader $14.9 billion investment in AI and digital infrastructure.

The partnership aligns with Saudi Arabia's ambitions to become a regional AI hub while giving DeepSeek access to high-end computing resources in a strategically important market. Saudi Aramco's leadership has praised DeepSeek's technology for bringing "huge changes" and operational efficiencies to the oil giant, indicating a deep strategic collaboration beyond simple infrastructure sharing.

By hosting DeepSeek's models on Saudi infrastructure, which may include advanced chips and novel architectures like Groq accelerators as part of Aramco's AI supercomputing investments, DeepSeek can serve Middle Eastern users with lower latency while diversifying its computational resources beyond China's borders.

Southeast Asia Workaround Strategy

In response to U.S. export controls on cutting-edge AI chips, DeepSeek has reportedly explored using data centers in Southeast Asia through shell companies and partnerships. According to U.S. officials, this strategy allows the company to remotely access data centers equipped with U.S.-made Nvidia GPUs that cannot be directly exported to China.

By processing AI workloads in offshore facilities, essentially renting cloud or server space in countries not subject to chip export bans, DeepSeek can tap into high-end Nvidia H100 GPUs and other restricted hardware. While it's not publicly confirmed which specific Southeast Asian data centers are involved, Singapore has been mentioned in related contexts, including a 2023 fraud case involving the routing of Nvidia chips to DeepSeek.

This approach represents a sophisticated workaround: while importing restricted chips into China is illegal, Chinese companies are technically allowed to use those chips via cloud or remote data centers abroad, provided the hosting provider isn't explicitly barred. U.S. officials have described DeepSeek as negotiating or quietly using Southeast Asian cloud resources to access "large volumes" of advanced GPUs despite sanctions.

The Infrastructure Playbook for Geopolitical Competition

DeepSeek's story proves that in 2025's tech competition, where you compute matters as much as how you compute. The startup's geographical chess game, pairing inland Chinese supercomputing hubs with offshore chip access, combining underwater cooling innovation with Saudi partnerships, shows that infrastructure diversification is now a survival strategy, not a luxury. For tech leaders watching this unfold, the lesson is stark: countries locked out of cutting-edge hardware won't simply concede the AI race. They'll build creative infrastructure networks that turn geographic constraints into strategic advantages, forcing a complete rethinking of how we regulate, secure, and compete in the AI era. DeepSeek built a roadmap for circumventing the global tech Cold War.